Tools To Keep Track Of Your Credit

Credit scores help keep track of your financial well-being, yet many people don’t understand the importance of tracking them. Credit scores are often used for job background checks and rental applications, along with loan and credit card approval. If you are not aware of your score, it could cause problems along the road. Tracking your credit score is also a good way to monitor any fraud or identity theft.

Getting information about your credit is easier than you might expect. We’ve simplified the process for you with a few helpful tools.

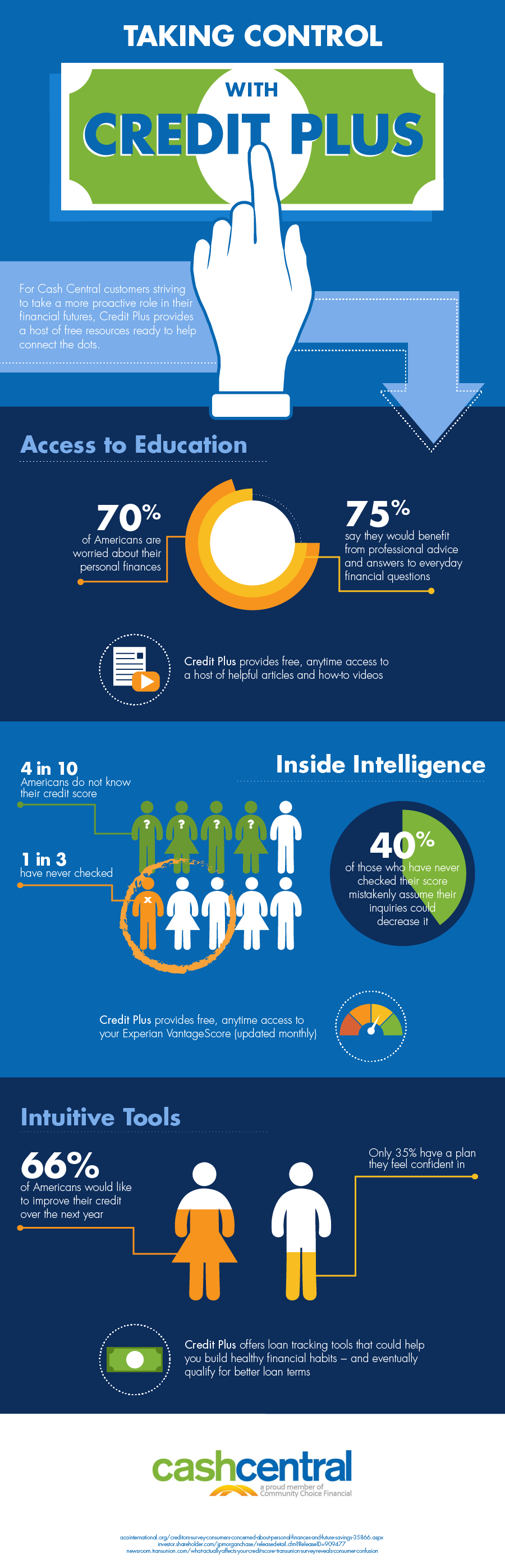

Credit Plus

“Credit Plus is completely free and doesn’t impact your credit in any way.”

Cash Central customers have access to a free tool called Credit Plus through their customer account. Through this, you can track your Experian® VantageScore credit score; it’s completely free and doesn’t impact your credit in any way. VantageScore is used by the three main credit reporting agencies, and is very similar to a traditional FICO credit score, with only a few differences. By knowing your score, you will have an idea of what to expect on loan applications and other items that use this information. It will also help to know where you stand if you are looking to raise your credit score.

In addition to viewing your credit score, Credit Plus has regularly updated financial education content. These two tools can help you monitor any problems with your credit with little hassle on your part. To sign up, simply login to Cash Central and click on Credit Plus to enroll! For more information, view the Credit Plus FAQ.

Three Reporting Agencies

Once a year you can request a free credit report from each of the three main credit reporting companies. These companies are Equifax, Experian, and TransUnion. These reports include information about your credit accounts, credit inquires, and public records (such as bankruptcies and law suits). Ideally, you could request a report every four months, rotating between the agencies to keep informed year-round. To request your report go to annualcreditreport.com and follow the three simple steps there. You will need to have your name, address, social security number, and date of birth at hand to gain access. In addition, they have secure questions they may ask you to verify your identity.

In case you find a problem with your report, the FTC details how to report problems here. Using Credit Plus in conjunction with the free credit reports will help you understand where you stand with your credit. Always be aware of your credit score and factors impacting your report so you don’t get caught unaware if problems arise.

The views expressed by the articles and sites linked in this post do not necessarily reflect the opinions and policies of Cash Central or Community Choice Financial.

You must have JavaScript enabled to use this site.

You must have JavaScript enabled to use this site.

For a better user experience consider upgrading your browser.

For a better user experience consider upgrading your browser.